Analyzing Credit Card Customer Churn Behaviour

Problem Statement: A manager at the bank is disturbed with more and more customers leaving their credit card services. They would really appreciate if one could predict for them who is considering leaving the bank so they can proactively go to the customer to provide them better services and reverse the customers' decision in their favour.

Dataset

| Clientnum | Num Client number. Unique identifier for the customer holding the account |

| Attrition_Flag | char Internal event (customer activity) variable |

| Customer_Age | Num Demographic variable - Customer's Age in Years |

| Gender | Char Demographic variable - M=Male, F=Female |

| Dependent_count | Num Demographic variable - Number of people dependents |

| Education_Level | Char Demographic variable - Educational Qualification of the account holder(example: high school, college graduate, etc.) |

| Marital_Status | Char Demographic variable - Married, Single, Unknown |

| Income_Category | Char Demographic variable - Annual Income Category of the account holder (< 40K, 40K - 60K, 60K - 80K, 80K-120K, > 120K, Unknown) |

| Card_Category | Char Product Variable - Type of Card (Blue, Silver, Gold, Platinum) |

| Months_on_book | Num Months on book (Time of Relationship) |

| Total_Relationship_Count | Num Total no. of products held by the customer |

| Months_Inactive_12_mon | Num No. of months inactive in the last 12 months |

| Contacts_Count_12_mon | Num No. of Contacts in the last 12 months |

| Credit_Limit | Num Credit Limit on the Credit Card |

| Total_Revolving_Bal | Num Total Revolving Balance on the Credit Card |

| Avg_Open_To_Buy | Num Open to Buy Credit Line (Average of last 12 months) |

| Total_Amt_Chng_Q4_Q1 | Num Change in Transaction Amount (Q4 over Q1) |

| Total_Trans_Amt | Num Total Transaction Amount (Last 12 months) |

| Total_Trans_Ct | Num Total Transaction Count (Last 12 months) |

| Total_Ct_Chng_Q4_Q1 | Num Change in Transaction Count (Q4 over Q1) |

| Avg_Utilization_Ratio | Num Average Card Utilization Ratio |

!wget https://github.com/tassneam/Credit-Card-Customers-Prediction/raw/main/BankChurners.csv -P dataset

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import plotly.graph_objs as go

from plotly.offline import iplot

import seaborn as sns

cc_df = pd.read_csv('dataset/BankChurners.csv')

cc_df.head(5).transpose()

# 5 rows × 23 columns

| 0 | 1 | 2 | 3 | 4 | |

|---|---|---|---|---|---|

| CLIENTNUM | 768805383 | 818770008 | 713982108 | 769911858 | 709106358 |

| Attrition_Flag | Existing Customer | Existing Customer | Existing Customer | Existing Customer | Existing Customer |

| Customer_Age | 45 | 49 | 51 | 40 | 40 |

| Gender | M | F | M | F | M |

| Dependent_count | 3 | 5 | 3 | 4 | 3 |

| Education_Level | High School | Graduate | Graduate | High School | Uneducated |

| Marital_Status | Married | Single | Married | Unknown | Married |

| Income_Category | 60𝐾−80K | Less than 40K | 80𝐾−120K | Less than 40K | 60𝐾−80K |

| Card_Category | Blue | Blue | Blue | Blue | Blue |

| Months_on_book | 39 | 44 | 36 | 34 | 21 |

| Total_Relationship_Count | 5 | 6 | 4 | 3 | 5 |

| Months_Inactive_12_mon | 1 | 1 | 1 | 4 | |

| Contacts_Count_12_mon | 3 | 2 | 0 | 1 | 0 |

| Credit_Limit | 12691.0 | 8256.0 | 3418.0 | 3313.0 | 4716.0 |

| Total_Revolving_Bal | 777 | 864 | 0 | 2517 | 0 |

| Avg_Open_To_Buy | 11914.0 | 7392.0 | 3418.0 | 796.0 | 4716.0 |

| Total_Amt_Chng_Q4_Q1 | 1.335 | 1.541 | 2.594 | 1.405 | 2.175 |

| Total_Trans_Amt | 1144 | 1291 | 1887 | 1171 | 816 |

| Total_Trans_Ct | 42 | 33 | 20 | 20 | 28 |

| Total_Ct_Chng_Q4_Q1 | 1.625 | 3.714 | 2.333 | 2.333 | 2.5 |

| Avg_Utilization_Ratio | 0.061 | 0.105 | 0.0 | 0.76 | 0.0 |

| Naive_Bayes_Classifier | 0.000093 | 0.000057 | 0.000021 | 0.000134 | 0.000022 |

| classification | True | True | True | True | True |

Preprocessing

Duplicates

print(cc_df.shape, cc_df['CLIENTNUM'].nunique())

# there are as many ClientIDs as there are rows :thumbsup:

# (2998, 23) 2998

cc_df.drop_duplicates(inplace=True)

cc_df.shape

# nothing is dropped :thumbsup:

# (2998, 23)

Subsetting

cc_df.columns

# Index(['CLIENTNUM', 'Attrition_Flag', 'Customer_Age', 'Gender',

# 'Dependent_count', 'Education_Level', 'Marital_Status',

# 'Income_Category', 'Card_Category', 'Months_on_book',

# 'Total_Relationship_Count', 'Months_Inactive_12_mon',

# 'Contacts_Count_12_mon', 'Credit_Limit', 'Total_Revolving_Bal',

# 'Avg_Open_To_Buy', 'Total_Amt_Chng_Q4_Q1', 'Total_Trans_Amt',

# 'Total_Trans_Ct', 'Total_Ct_Chng_Q4_Q1', 'Avg_Utilization_Ratio',

# 'Naive_Bayes_Classifier', 'classification'],

# dtype='object')

# drop what you don't need

cc_df_ss = cc_df[['CLIENTNUM', 'Attrition_Flag', 'Customer_Age', 'Gender',

'Dependent_count', 'Education_Level', 'Marital_Status',

'Income_Category', 'Card_Category', 'Months_on_book',

'Total_Relationship_Count', 'Months_Inactive_12_mon',

'Contacts_Count_12_mon', 'Credit_Limit', 'Total_Revolving_Bal',

'Avg_Open_To_Buy', 'Total_Amt_Chng_Q4_Q1', 'Total_Trans_Amt',

'Total_Trans_Ct', 'Total_Ct_Chng_Q4_Q1', 'Avg_Utilization_Ratio']]

cc_df_ss.shape

# (2998, 21)

Datatypes

# check if int/float/datetime values are not strings

cc_df_ss.dtypes

| CLIENTNUM | int64 |

| Attrition_Flag | object |

| Customer_Age | int64 |

| Gender | object |

| Dependent_count | int64 |

| Education_Level | object |

| Marital_Status | object |

| Income_Category | object |

| Card_Category | object |

| Months_on_book | int64 |

| Total_Relationship_Count | int64 |

| Months_Inactive_12_mon | int64 |

| Contacts_Count_12_mon | int64 |

| Credit_Limit | float64 |

| Total_Revolving_Bal | int64 |

| Avg_Open_To_Buy | float64 |

| Total_Amt_Chng_Q4_Q1 | float64 |

| Total_Trans_Amt | int64 |

| Total_Trans_Ct | int64 |

| Total_Ct_Chng_Q4_Q1 | float64 |

| Avg_Utilization_Ratio | float64 |

| dtype: object |

Missing Values

# test for missing data

cc_df_ss.isnull().sum()

| CLIENTNUM | 0 |

| Attrition_Flag | 0 |

| Customer_Age | 0 |

| Gender | 0 |

| Dependent_count | 0 |

| Education_Level | 0 |

| Marital_Status | 0 |

| Income_Category | 0 |

| Card_Category | 0 |

| Months_on_book | 0 |

| Total_Relationship_Count | 0 |

| Months_Inactive_12_mon | 0 |

| Contacts_Count_12_mon | 0 |

| Credit_Limit | 0 |

| Total_Revolving_Bal | 0 |

| Avg_Open_To_Buy | 0 |

| Total_Amt_Chng_Q4_Q1 | 0 |

| Total_Trans_Amt | 0 |

| Total_Trans_Ct | 0 |

| Total_Ct_Chng_Q4_Q1 | 0 |

| Avg_Utilization_Ratio | 0 |

Data Transformation

Binning

print(

cc_df_ss['Customer_Age'].min(),

cc_df_ss['Customer_Age'].max()

)

# 26 73 => bins=[20,30,40,50,60,70,80]

bins=[20,30,40,50,60,70,80]

labels=['20s','30s','40s','50s','60s','70s','80s']

cc_df_ss['Customer_Age_Bins'] = pd.cut(

cc_df_ss['Customer_Age'],

bins,

labels,

include_lowest=True

)

cc_df_ss.head(5).transpose()

| 0 | 1 | 2 | 3 | 4 | |

|---|---|---|---|---|---|

| CLIENTNUM | 768805383 | 818770008 | 713982108 | 769911858 | 709106358 |

| Attrition_Flag | Existing Customer | Existing Customer | Existing Customer | Existing Customer | Existing Customer |

| Customer_Age | 45 | 49 | 51 | 40 | 40 |

| Gender | M | F | M | F | M |

| Dependent_count | 3 | 5 | 3 | 4 | 3 |

| Education_Level | High School | Graduate | Graduate | High School | Uneducated |

| Marital_Status | Married | Single | Married | Unknown | Married |

| Income_Category | 60𝐾−80K | Less than 40K | 80𝐾−120K | Less than 40K | 60𝐾−80K |

| Card_Category | Blue | Blue | Blue | Blue | Blue |

| Months_on_book | 39 | 44 | 36 | 34 | 21 |

| Total_Relationship_Count | 5 | 6 | 4 | 3 | 5 |

| Months_Inactive_12_mon | 1 | 1 | 1 | 4 | 1 |

| Contacts_Count_12_mon | 3 | 2 | 0 | 1 | 0 |

| Credit_Limit | 12691.0 | 8256.0 | 3418.0 | 3313.0 | 4716.0 |

| Total_Revolving_Bal | 777 | 864 | 0 | 2517 | 0 |

| Avg_Open_To_Buy | 11914.0 | 7392.0 | 3418.0 | 796.0 | 4716.0 |

| Total_Amt_Chng_Q4_Q1 | 1.335 | 1.541 | 2.594 | 1.405 | 2.175 |

| Total_Trans_Amt | 1144 | 1291 | 1887 | 1171 | 816 |

| Total_Trans_Ct | 42 | 33 | 20 | 20 | 28 |

| Total_Ct_Chng_Q4_Q1 | 1.625 | 3.714 | 2.333 | 2.333 | 2.5 |

| Avg_Utilization_Ratio | 0.061 | 0.105 | 0.0 | 0.76 | 0.0 |

| Customer_Age_Bins | (40.0, 50.0] | (40.0, 50.0] | (50.0, 60.0] | (30.0, 40.0] | (30.0, 40.0] |

Data Exploration

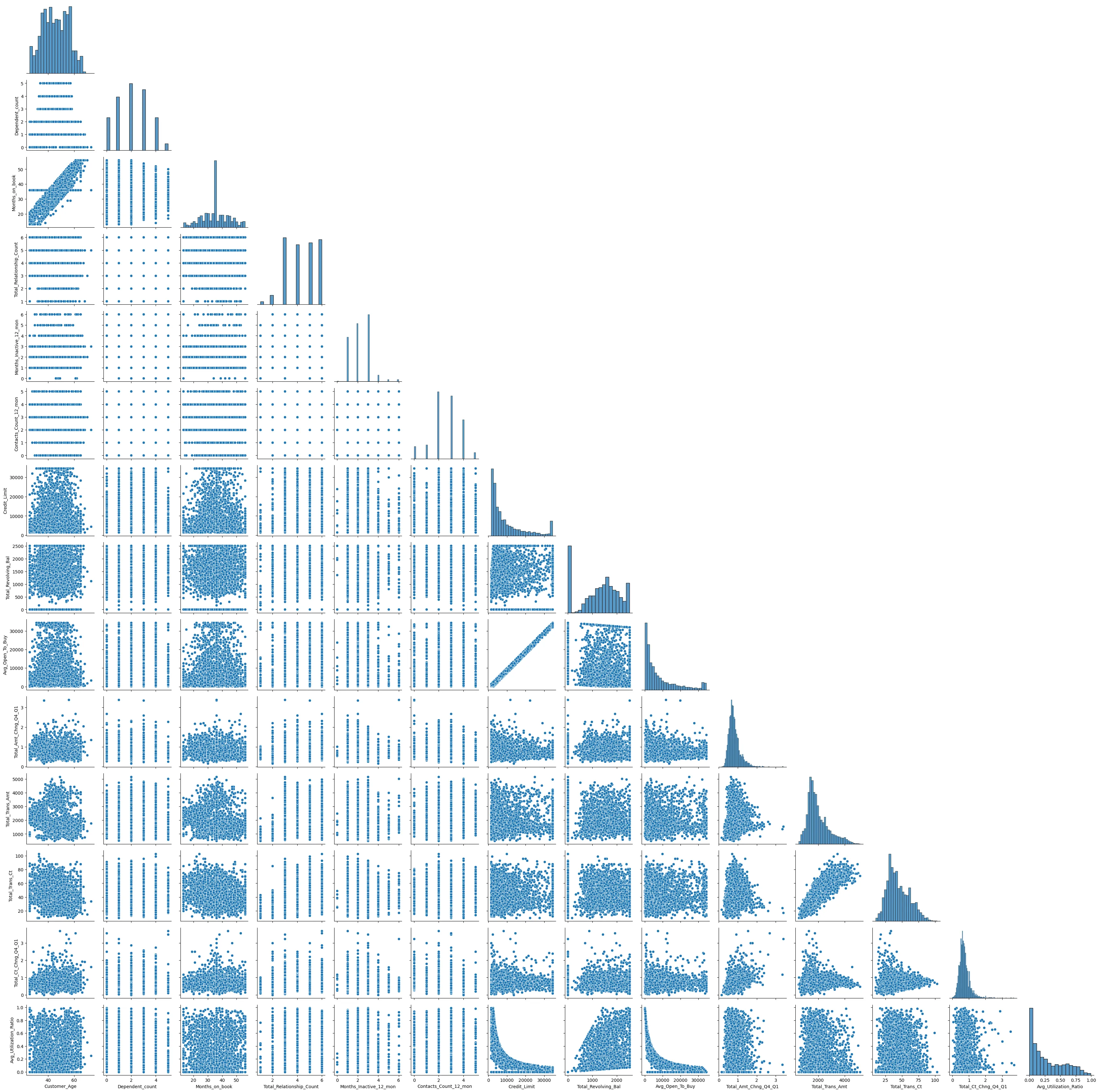

Scatterplots

cc_df_ss.columns

# find correlations using a pairplot

# remove unecessary columns

temp = cc_df_ss[['Attrition_Flag', 'Customer_Age', 'Gender',

'Dependent_count', 'Education_Level', 'Marital_Status',

'Income_Category', 'Card_Category', 'Months_on_book',

'Total_Relationship_Count', 'Months_Inactive_12_mon',

'Contacts_Count_12_mon', 'Credit_Limit', 'Total_Revolving_Bal',

'Avg_Open_To_Buy', 'Total_Amt_Chng_Q4_Q1', 'Total_Trans_Amt',

'Total_Trans_Ct', 'Total_Ct_Chng_Q4_Q1', 'Avg_Utilization_Ratio']]

# remove categorical columns

numeric_data_df = temp._get_numeric_data()

numeric_data_df.head(5).transpose()

| 0 | 1 | 2 | 3 | 4 | |

|---|---|---|---|---|---|

| Customer_Age | 45.000 | 49.000 | 51.000 | 40.000 | 40.000 |

| Dependent_count | 3.000 | 5.000 | 3.000 | 4.000 | 3.000 |

| Months_on_book | 39.000 | 44.000 | 36.000 | 34.000 | 21.000 |

| Total_Relationship_Count | 5.000 | 6.000 | 4.000 | 3.000 | 5.000 |

| Months_Inactive_12_mon | 1.000 | 1.000 | 1.000 | 4.000 | 1.000 |

| Contacts_Count_12_mon | 3.000 | 2.000 | 0.000 | 1.000 | 0.000 |

| Credit_Limit | 12691.000 | 8256.000 | 3418.000 | 3313.000 | 4716.000 |

| Total_Revolving_Bal | 777.000 | 864.000 | 0.000 | 2517.000 | 0.000 |

| Avg_Open_To_Buy | 11914.000 | 7392.000 | 3418.000 | 796.000 | 4716.000 |

| Total_Amt_Chng_Q4_Q1 | 1.335 | 1.541 | 2.594 | 1.405 | 2.175 |

| Total_Trans_Amt | 1144.000 | 1291.000 | 1887.000 | 1171.000 | 816.000 |

| Total_Trans_Ct | 42.000 | 33.000 | 20.000 | 20.000 | 28.000 |

| Total_Ct_Chng_Q4_Q1 | 1.625 | 3.714 | 2.333 | 2.333 | 2.500 |

| Avg_Utilization_Ratio | 0.061 | 0.105 | 0.000 | 0.760 | 0.000 |

pairgrid = sns.PairGrid(

data=numeric_data_df,

diag_sharey=False,

corner=True

)

pairgrid.map_lower(sns.scatterplot)

pairgrid.map_diag(sns.histplot)

plt.savefig('../assets/CC_Customer_Churn_13.webp', bbox_inches='tight')

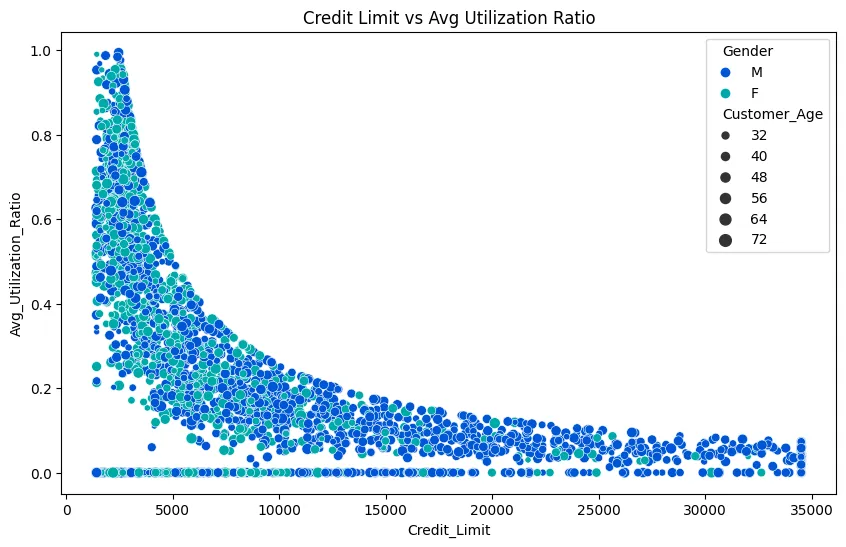

# dive deeper into plots with interesting correlations

plt.figure(figsize=(10, 6))

# hue/size by continuous column

sns.scatterplot(

data=cc_df_ss,

x='Credit_Limit',

y='Avg_Utilization_Ratio',

hue='Gender',

palette='winter',

size='Customer_Age'

).set_title('Credit Limit vs Avg Utilization Ratio')

plt.savefig('../assets/CC_Customer_Churn_14.webp', bbox_inches='tight')

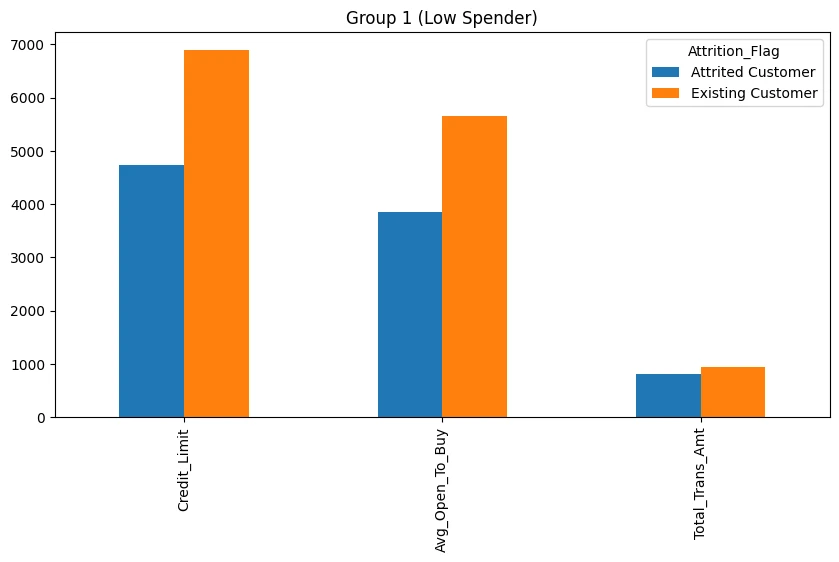

Investigate Subgroups

# compare high to low spender

bins = [

cc_df_ss['Total_Trans_Amt'].min(),

1000,

cc_df_ss['Total_Trans_Amt'].max()

]

labels = ['Group 1', "Group 2"]

cc_df_ss_temp = cc_df_ss.copy()

cc_df_ss_temp['Total_Trans_Amt_Grp'] = pd.cut(

cc_df_ss['Total_Trans_Amt'],

bins=bins,

labels=labels,

include_lowest=True

)

cc_df_ss_temp.head(1).transpose()

| 0 | |

|---|---|

| CLIENTNUM | 768805383 |

| Attrition_Flag | Existing Customer |

| Customer_Age | 45 |

| Gender | M |

| Dependent_count | 3 |

| Education_Level | High School |

| Marital_Status | Married |

| Income_Category | 60𝐾−80K |

| Card_Category | Blue |

| Months_on_book | 39 |

| Total_Relationship_Count | 5 |

| Months_Inactive_12_mon | 1 |

| Contacts_Count_12_mon | 3 |

| Credit_Limit | 12691.0 |

| Total_Revolving_Bal | 777 |

| Avg_Open_To_Buy | 11914.0 |

| Total_Amt_Chng_Q4_Q1 | 1.335 |

| Total_Trans_Amt | 1144 |

| Total_Trans_Ct | 42 |

| Total_Ct_Chng_Q4_Q1 | 1.625 |

| Avg_Utilization_Ratio | 0.061 |

| Customer_Age_Bins | (40.0, 50.0] |

| Total_Trans_Amt_Grp | Group 2 |

cc_df_ss_temp = cc_df_ss_temp.groupby(['Total_Trans_Amt_Grp', 'Attrition_Flag']).agg({

'CLIENTNUM':'nunique',

'Customer_Age':'median',

'Dependent_count':'median',

'Months_on_book':'median',

'Total_Relationship_Count':'median',

'Months_Inactive_12_mon':'median',

'Contacts_Count_12_mon':'median',

'Credit_Limit':'median',

'Total_Revolving_Bal':'median',

'Avg_Open_To_Buy':'median',

'Total_Amt_Chng_Q4_Q1':'median',

'Total_Trans_Amt':'median',

'Total_Trans_Ct':'median',

'Total_Ct_Chng_Q4_Q1':'median',

'Avg_Utilization_Ratio':'median',

})

cc_df_ss_temp.transpose()

| Total_Trans_Amt_Grp | Group 1 | Group 2 | ||

|---|---|---|---|---|

| Attrition_Flag | Attrited Customer | Existing Customer | Attrited Customer | Existing Customer |

| CLIENTNUM | 142.0000 | 19.000 | 82.00 | 2755.000 |

| Customer_Age | 49.0000 | 44.000 | 48.00 | 46.000 |

| Dependent_count | 2.0000 | 2.000 | 2.00 | 2.000 |

| Months_on_book | 36.0000 | 36.000 | 36.00 | 36.000 |

| Total_Relationship_Count | 3.0000 | 5.000 | 3.00 | 5.000 |

| Months_Inactive_12_mon | 3.0000 | 2.000 | 3.00 | 2.000 |

| Contacts_Count_12_mon | 3.0000 | 2.000 | 3.00 | 3.000 |

| Credit_Limit | 4740.5000 | 6884.000 | 7618.00 | 5550.000 |

| Total_Revolving_Bal | 0.0000 | 1330.000 | 0.00 | 1475.000 |

| Avg_Open_To_Buy | 3854.0000 | 5653.000 | 6410.00 | 4237.000 |

| Total_Amt_Chng_Q4_Q1 | 0.7250 | 0.781 | 0.77 | 0.761 |

| Total_Trans_Amt | 810.0000 | 949.000 | 1353.00 | 1805.000 |

| Total_Trans_Ct | 20.0000 | 24.000 | 33.00 | 43.000 |

| Total_Ct_Chng_Q4_Q1 | 0.4645 | 0.909 | 0.46 | 0.682 |

| Avg_Utilization_Ratio | 0.0000 | 0.152 | 0.00 | 0.210 |

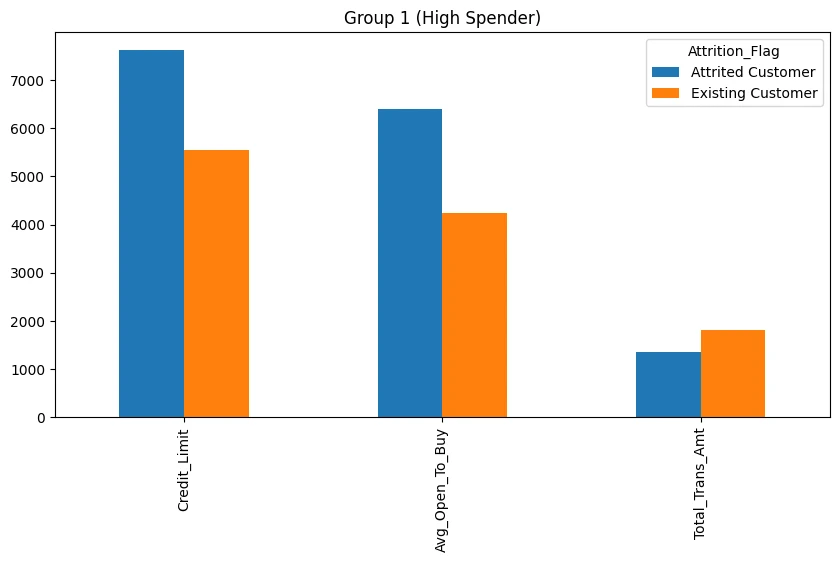

cc_df_ss_temp.transpose()['Group 1'].loc[

[

'Credit_Limit',

'Avg_Open_To_Buy',

'Total_Trans_Amt'

]

]

| Attrition_Flag | Attrited Customer | Existing Customer |

|---|---|---|

| Credit_Limit | 4740.5 | 6884.0 |

| Avg_Open_To_Buy | 3854.0 | 5653.0 |

| Total_Trans_Amt | 810.0 | 949.0 |

cc_df_ss_temp.transpose()['Group 1'].loc[

['Credit_Limit','Avg_Open_To_Buy','Total_Trans_Amt']

].plot.bar(

figsize=(10,5),

subplots=False,

legend=True,

sharey=True,

layout=(1,2),

title='Group 1 (Low Spender)'

)

cc_df_ss_temp.transpose()['Group 2'].loc[

['Credit_Limit','Avg_Open_To_Buy','Total_Trans_Amt']

].plot.bar(

figsize=(10,5),

subplots=False,

legend=True,

sharey=True,

layout=(1,2),

title='Group 1 (High Spender)'

)

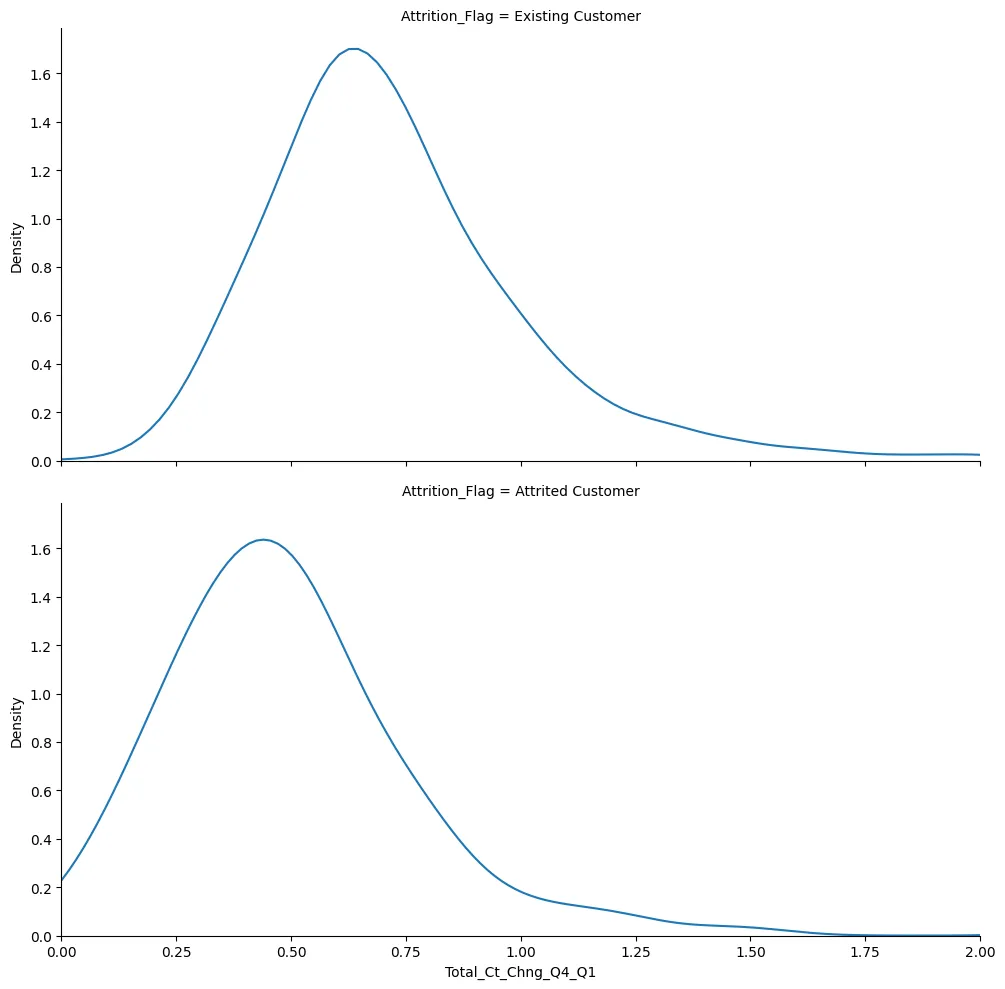

plot = sns.FacetGrid(

cc_df_ss,

row='Attrition_Flag',

height=5,

aspect=2

)

plot.map_dataframe(

sns.kdeplot,

x='Total_Ct_Chng_Q4_Q1'

)

plt.xlim(0,2)

plt.savefig('../assets/CC_Customer_Churn_15.webp', bbox_inches='tight')

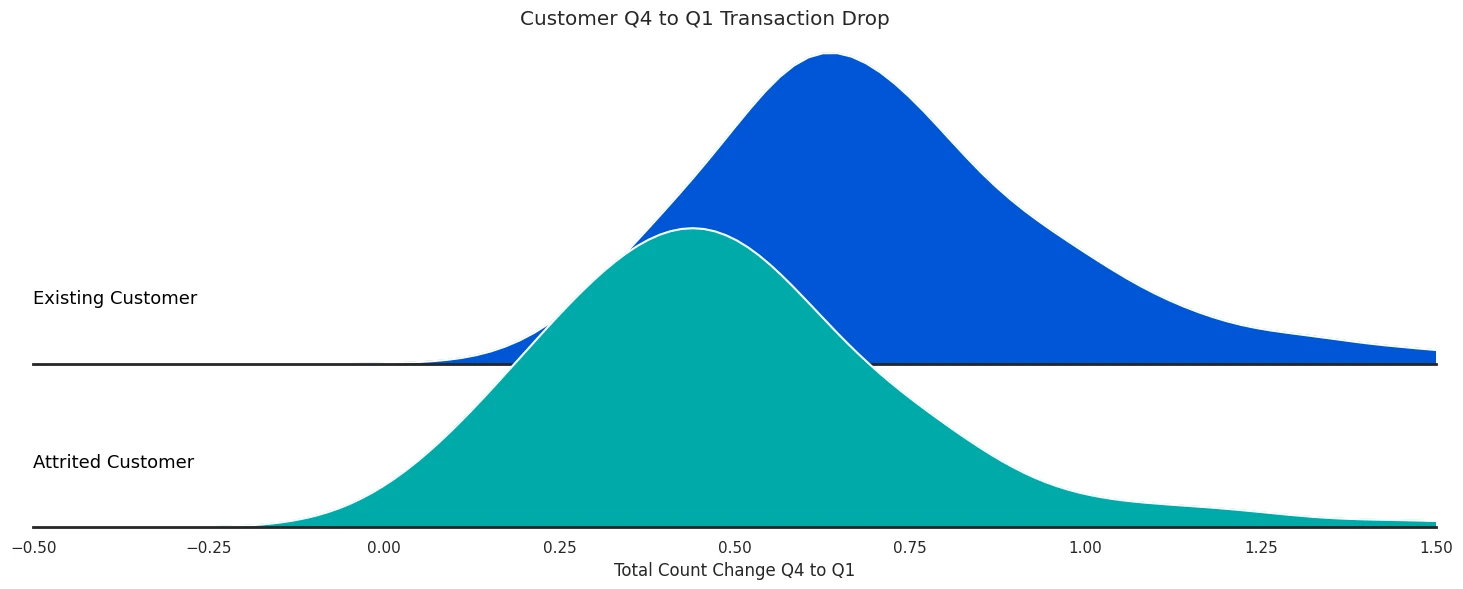

palette = sns.color_palette('winter', 2)

def label(x, color, label):

ax = plt.gca()

ax.text(0, .2, label, color='black', fontsize=13,

ha='left', va='center', transform=ax.transAxes)

sns.set_theme(

style='white',

rc={'axes.facecolor': (0, 0, 0, 0), 'axes.linewidth':2}

)

fg = sns.FacetGrid(

cc_df_ss,

palette=palette,

hue='Attrition_Flag',

row='Attrition_Flag',

aspect=5,

height=3

)

fg.map_dataframe(

sns.kdeplot,

x='Total_Ct_Chng_Q4_Q1',

fill=True,

alpha=1

)

fg.map_dataframe(

sns.kdeplot,

x='Total_Ct_Chng_Q4_Q1',

color='white'

)

fg.map(label, 'Attrition_Flag')

fg.fig.subplots_adjust(hspace=-.5)

fg.set_titles('')

fg.set(yticks=[], ylabel='', xlabel='Total Count Change Q4 to Q1')

fg.despine(left=True)

plt.suptitle('Customer Q4 to Q1 Transaction Drop', y=0.98)

plt.xlim(-0.5,1.5)

Histograms

plt.hist(

cc_df_ss['Customer_Age'],

bins=7,

histtype='step'

)

plt.title('Customer Age Histogram')

plt.xlabel('Age Group')

plt.ylabel('Count')

# find churn percentage

cc_df_ss['Attrition_Flag'].value_counts()

# Existing Customer 2774

# Attrited Customer 224

# Name: Attrition_Flag, dtype: int64

percentage = cc_df_ss['Attrition_Flag'].value_counts()['Attrited Customer'] / cc_df_ss.shape[0] * 100

print(f"Attrited Customers: {round(percentage)}%")

# Attrited Customers: 7%

plt.hist(

cc_df_ss['Months_on_book'],

bins=20,

histtype='step'

)

plt.title('Customer Months on book (Time of Relationship)')

plt.xlabel('Months on Book')

plt.ylabel('Count')

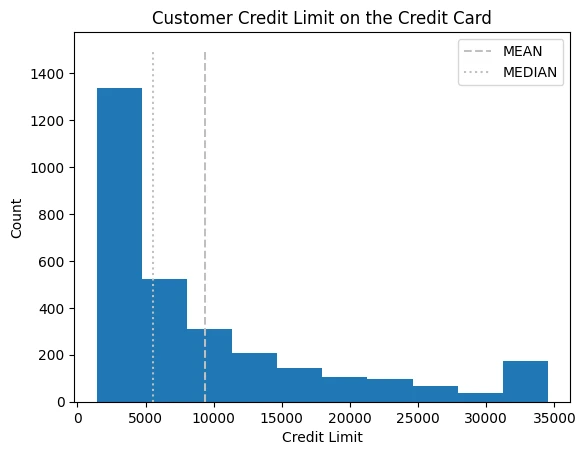

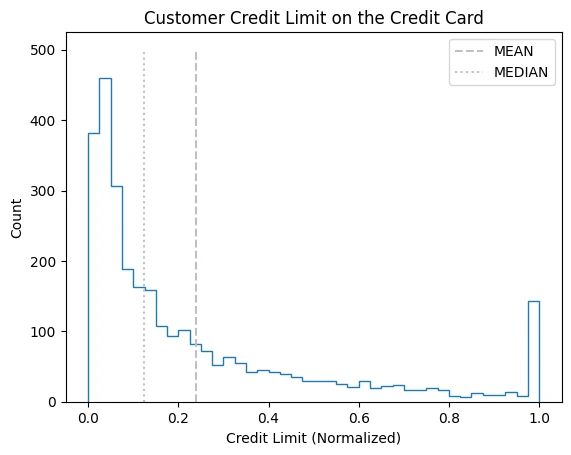

plt.hist(

cc_df_ss['Credit_Limit'],

)

plt.vlines(

x=cc_df_ss['Credit_Limit'].mean(),

ymin=0, ymax=1500, colors='0.75',

linestyles='dashed', label='MEAN'

)

plt.vlines(

x=cc_df_ss['Credit_Limit'].median(),

ymin=0, ymax=1500, colors='0.75',

linestyles='dotted', label='MEDIAN'

)

plt.title('Customer Credit Limit on the Credit Card')

plt.xlabel('Credit Limit')

plt.ylabel('Count')

plt.legend()

The Mean is more influenced by outliers than the Median function. Use median() when your distribution deviates from a normal distribution.

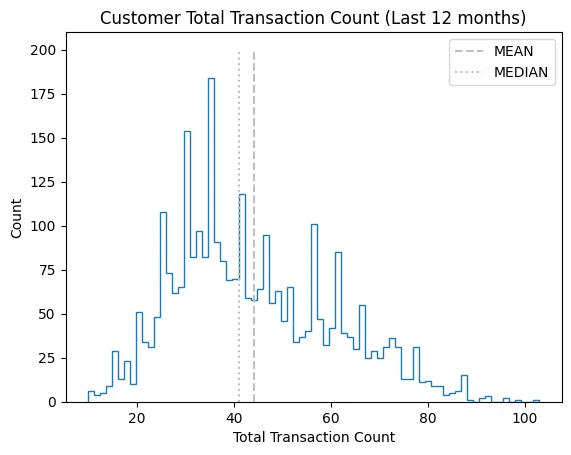

plt.hist(

cc_df_ss['Total_Trans_Ct'],

bins=75,

histtype='step'

)

plt.vlines(

x=cc_df_ss['Total_Trans_Ct'].mean(),

ymin=0, ymax=200, colors='0.75',

linestyles='dashed', label='MEAN'

)

plt.vlines(

x=cc_df_ss['Total_Trans_Ct'].median(),

ymin=0, ymax=200, colors='0.75',

linestyles='dotted', label='MEDIAN'

)

plt.title('Customer Total Transaction Count (Last 12 months)')

plt.xlabel('Total Transaction Count')

plt.ylabel('Count')

plt.legend()

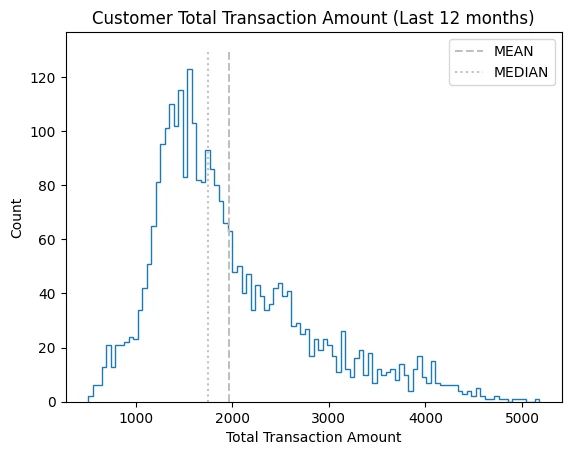

plt.hist(

cc_df_ss['Total_Trans_Amt'],

bins=100,

histtype='step'

)

plt.vlines(

x=cc_df_ss['Total_Trans_Amt'].mean(),

ymin=0, ymax=130, colors='0.75',

linestyles='dashed', label='MEAN'

)

plt.vlines(

x=cc_df_ss['Total_Trans_Amt'].median(),

ymin=0, ymax=130, colors='0.75',

linestyles='dotted', label='MEDIAN'

)

plt.title('Customer Total Transaction Amount (Last 12 months)')

plt.xlabel('Total Transaction Amount')

plt.ylabel('Count')

plt.legend()

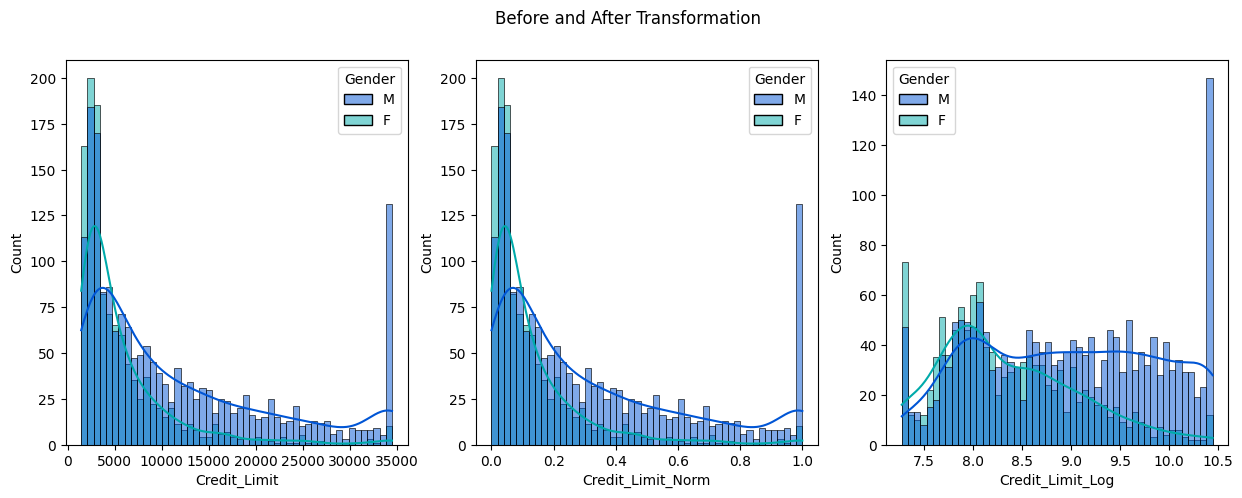

Data Transformation

Normalization

def normalize(column):

upper = column.max()

lower = column.min()

norm = (column - lower)/(upper - lower)

return norm

cc_df_ss['Credit_Limit_Norm'] = normalize(cc_df_ss['Credit_Limit'])

plt.hist(

x=cc_df_ss['Credit_Limit_Norm'],

bins=40,

histtype='step'

)

plt.vlines(

x=cc_df_ss['Credit_Limit_Norm'].mean(),

ymin=0, ymax=500, colors='0.75',

linestyles='dashed', label='MEAN'

)

plt.vlines(

x=cc_df_ss['Credit_Limit_Norm'].median(),

ymin=0, ymax=500, colors='0.75',

linestyles='dotted', label='MEDIAN'

)

plt.title('Customer Credit Limit on the Credit Card')

plt.xlabel('Credit Limit (Normalized)')

plt.ylabel('Count')

plt.legend()

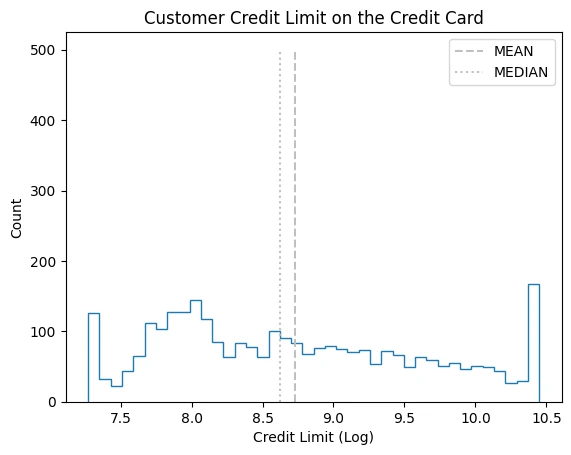

Log Transform

cc_df_ss['Credit_Limit_Log'] = np.log(cc_df_ss['Credit_Limit'])

plt.hist(

x=cc_df_ss['Credit_Limit_Log'],

bins=40,

histtype='step'

)

plt.vlines(

x=cc_df_ss['Credit_Limit_Log'].mean(),

ymin=0, ymax=500, colors='0.75',

linestyles='dashed', label='MEAN'

)

plt.vlines(

x=cc_df_ss['Credit_Limit_Log'].median(),

ymin=0, ymax=500, colors='0.75',

linestyles='dotted', label='MEDIAN'

)

plt.title('Customer Credit Limit on the Credit Card')

plt.xlabel('Credit Limit (Log)')

plt.ylabel('Count')

plt.legend()

fig, axes = plt.subplots(1, 3, figsize=(15, 5))

fig.suptitle('Before and After Transformation')

sns.histplot(

data=cc_df_ss,

x='Credit_Limit',

bins=50,

hue='Gender',

palette='winter',

kde=True,

ax=axes[0]

)

sns.histplot(

data=cc_df_ss,

x='Credit_Limit_Norm',

bins=50,

hue='Gender',

palette='winter',

kde=True,

ax=axes[1]

)

sns.histplot(

data=cc_df_ss,

x='Credit_Limit_Log',

bins=50,

hue='Gender',

palette='winter',

kde=True,

ax=axes[2]

)

More Distribution Plot

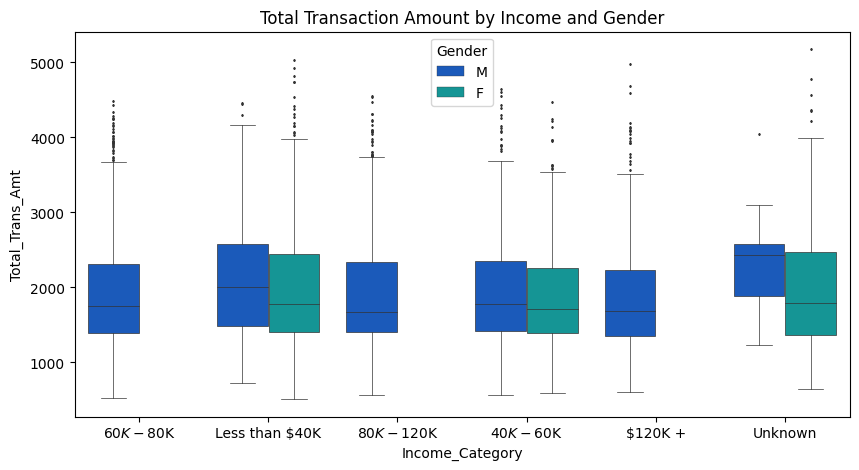

Box Plot

plt.figure(figsize=(10, 5))

plt.title('Total Transaction Amount by Income and Gender')

plot = sns.boxplot(

data=cc_df_ss,

y='Total_Trans_Amt',

x='Income_Category',

hue='Gender',

palette='winter',

orient='v',

linewidth=0.5,

fliersize=1

)

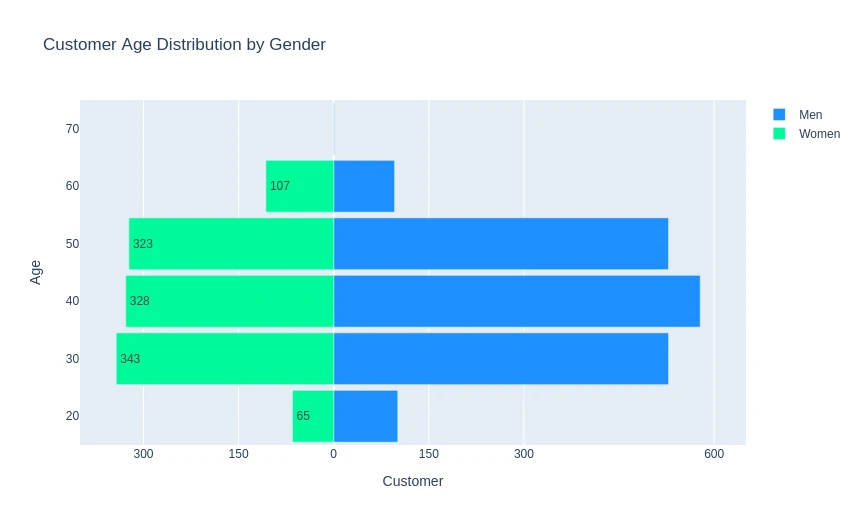

Pyramid Chart

# count customers in age bins and classify by gender

cc_gen_age = cc_df_ss.groupby(

['Gender', 'Customer_Age_Bins']

)['CLIENTNUM'].nunique().reset_index()

cc_gen_age.head(5)

| Gender | Customer_Age_Bins | CLIENTNUM | |

|---|---|---|---|

| 0 | F | (19.999, 30.0] | 65 |

| 1 | F | (30.0, 40.0] | 343 |

| 2 | F | (40.0, 50.0] | 328 |

| 3 | F | (50.0, 60.0] | 323 |

| 4 | F | (60.0, 70.0] | 107 |

women_bins = np.array(-1 * cc_gen_age[cc_gen_age['Gender'] == 'F']['CLIENTNUM'])

men_bins = np.array(cc_gen_age[cc_gen_age['Gender'] == 'M']['CLIENTNUM'])

y = list(range(20, 100, 10))

layout = go.Layout(

title='Customer Age Distribution by Gender',

yaxis=go.layout.YAxis(title='Age'),

xaxis=go.layout.XAxis(

range=[-400, 650],

tickvals=[-300, -150, 0, 150, 300, 600],

ticktext=[300, 150, 0, 150, 300, 600],

title='Customer'),

barmode='overlay',

bargap=0.1)

p_data = [go.Bar(y=y,

x=men_bins,

orientation='h',

name='Men',

hoverinfo='x',

marker=dict(color='dodgerblue')

),

go.Bar(y=y,

x=woman_bins,

orientation='h',

name='Women',

text=-1 * women_bins.astype('int'),

hoverinfo='text',

marker=dict(color='mediumspringgreen')

)]

iplot(dict(data=p_data, layout=layout))

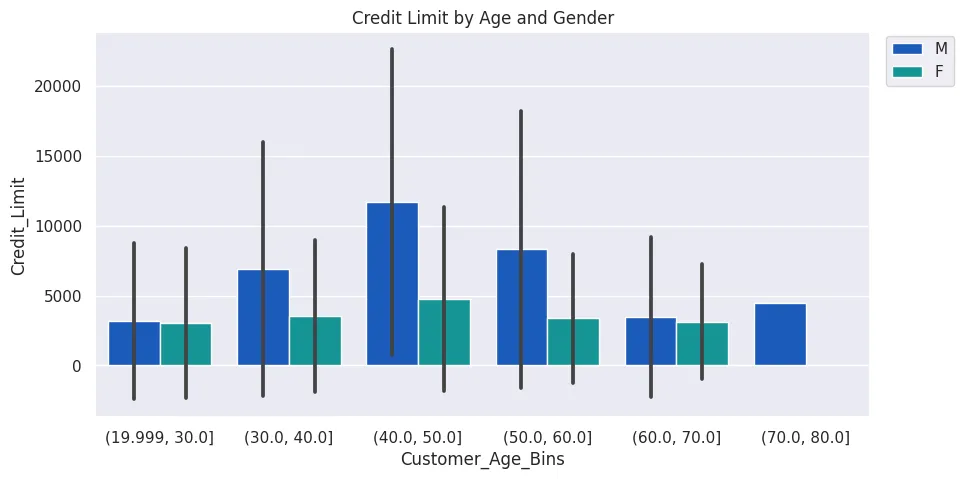

Bar Chart

plt.figure(figsize=(10, 5))

plt.title('Credit Limit by Age and Gender')

sns.set(style='darkgrid')

sns.barplot(

data=cc_df_ss,

x='Customer_Age_Bins',

y='Credit_Limit',

estimator=np.median,

errorbar='sd',

hue='Gender',

palette='winter'

)

plt.legend(bbox_to_anchor=(1.01,1.01))

plt.savefig('../assets/CC_Customer_Churn_11.webp', bbox_inches='tight')

Aggregations

cc_df_attr = cc_df_ss.groupby(['Attrition_Flag']).agg({

'CLIENTNUM':'nunique',

'Customer_Age':'median',

'Dependent_count':'median',

'Months_on_book':'median',

'Total_Relationship_Count':'median',

'Months_Inactive_12_mon':'median',

'Contacts_Count_12_mon':'median',

'Credit_Limit':'median',

'Total_Revolving_Bal':'median',

'Avg_Open_To_Buy':'median',

'Total_Amt_Chng_Q4_Q1':'median',

'Total_Trans_Amt':'median',

'Total_Trans_Ct':'median',

'Total_Ct_Chng_Q4_Q1':'median',

'Avg_Utilization_Ratio':'median',

})

cc_df_attr_trans = cc_df_attr.transpose().reset_index()

cc_df_attr_trans

| Attrition_Flag | index | Attrited Customer | Existing Customer |

|---|---|---|---|

| 0 | CLIENTNUM | 224.0000 | 2774.000 |

| 1 | Customer_Age | 48.0000 | 46.000 |

| 2 | Dependent_count | 2.0000 | 2.000 |

| 3 | Months_on_book | 36.0000 | 36.000 |

| 4 | Total_Relationship_Count | 3.0000 | 5.000 |

| 5 | Months_Inactive_12_mon | 3.0000 | 2.000 |

| 6 | Contacts_Count_12_mon | 3.0000 | 3.000 |

| 7 | Credit_Limit | 5687.5000 | 5553.000 |

| 8 | Total_Revolving_Bal | 0.0000 | 1474.500 |

| 9 | Avg_Open_To_Buy | 5189.5000 | 4245.000 |

| 10 | Total_Amt_Chng_Q4_Q1 | 0.7375 | 0.762 |

| 11 | Total_Trans_Amt | 911.0000 | 1802.000 |

| 12 | Total_Trans_Ct | 24.0000 | 42.000 |

| 13 | Total_Ct_Chng_Q4_Q1 | 0.4620 | 0.682 |

| 14 | Avg_Utilization_Ratio | 0.0000 | 0.209 |

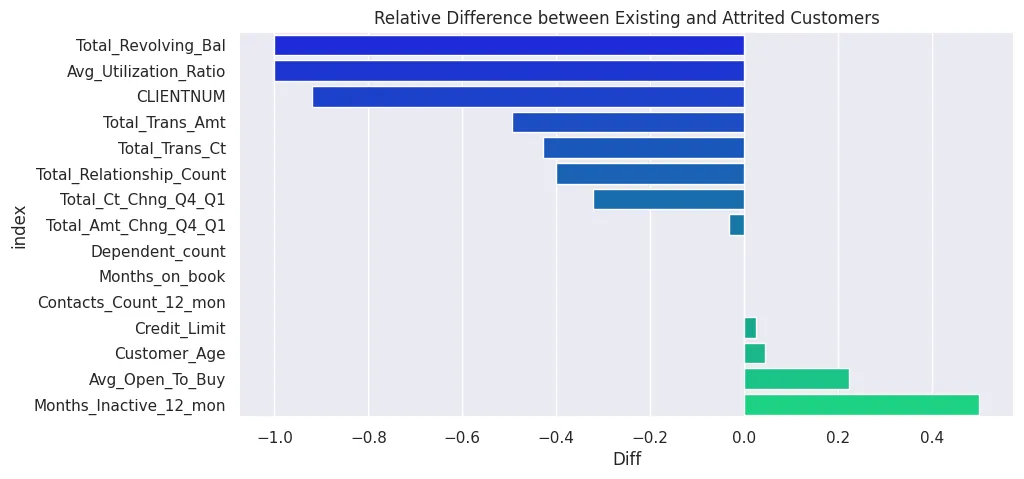

# sort by greatest difference

cc_df_attr_trans['Diff'] = cc_df_attr_trans['Attrited Customer'] / cc_df_attr_trans['Existing Customer'] - 1

cc_df_attr_trans = cc_df_attr_trans.sort_values('Diff')

cc_df_attr_trans

| Attrition_Flag | index | Attrited Customer | Existing Customer | Diff |

|---|---|---|---|---|

| 8 | Total_Revolving_Bal | 0.0000 | 1474.500 | -1.000000 |

| 14 | Avg_Utilization_Ratio | 0.0000 | 0.209 | -1.000000 |

| 0 | CLIENTNUM | 224.0000 | 2774.000 | -0.919250 |

| 11 | Total_Trans_Amt | 911.0000 | 1802.000 | -0.494451 |

| 12 | Total_Trans_Ct | 24.0000 | 42.000 | -0.428571 |

| 4 | Total_Relationship_Count | 3.0000 | 5.000 | -0.400000 |

| 13 | Total_Ct_Chng_Q4_Q1 | 0.4620 | 0.682 | -0.322581 |

| 10 | Total_Amt_Chng_Q4_Q1 | 0.7375 | 0.762 | -0.032152 |

| 2 | Dependent_count | 2.0000 | 2.000 | 0.000000 |

| 3 | Months_on_book | 36.0000 | 36.000 | 0.000000 |

| 6 | Contacts_Count_12_mon | 3.0000 | 3.000 | 0.000000 |

| 7 | Credit_Limit | 5687.5000 | 5553.000 | 0.024221 |

| 1 | Customer_Age | 48.0000 | 46.000 | 0.043478 |

| 9 | Avg_Open_To_Buy | 5189.5000 | 4245.000 | 0.222497 |

| 5 | Months_Inactive_12_mon | 3.0000 | 2.000 | 0.500000 |

plt.figure(figsize=(10, 5))

plt.title('Relative Difference between Existing and Attrited Customers')

sns.set(style='darkgrid')

sns.barplot(

data=cc_df_attr_trans,

x='Diff',

y='index',

estimator=np.median,

errorbar='sd',

palette='winter',

orient='h'

)

plt.savefig('../assets/CC_Customer_Churn_12.webp', bbox_inches='tight')